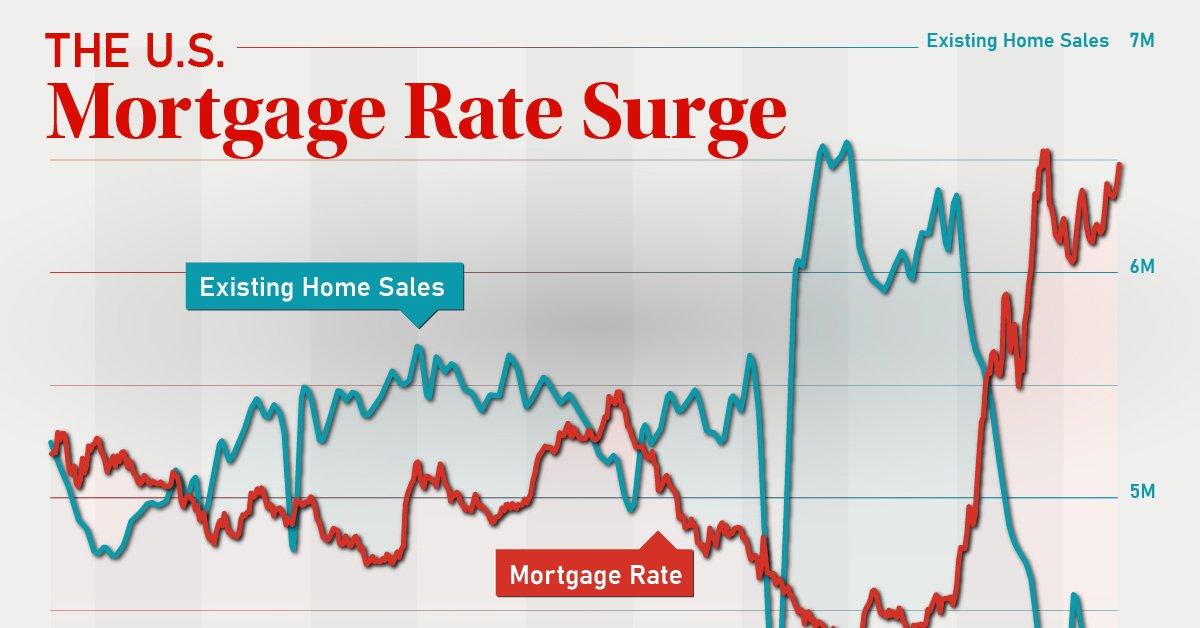

In a startling turn of events, the housing market is facing a tumultuous period as housing mortgage rates skyrocket to near-2008 levels. According to recent data from Freddie Mac, the average 30-year fixed mortgage rate has surged to a staggering 7.98%, up by 6 basis points in just one week. The 15-year fixed mortgage rate has not fared any better, rising to 7.14%, marking a 7 basis point increase.

Factors Behind the Surge

The surge in mortgage rates can be attributed to a confluence of factors that are sending shockwaves through the real estate market. Among these, inflation and the Federal Reserve’s unwavering commitment to tightening monetary policy have played pivotal roles in this dramatic increase. As a result, buying a home has become a notably more expensive endeavor.

Impact on Different Segments

- Homebuyers

For prospective homebuyers, the outlook is less than promising. Those with plans to purchase a home in the near future should brace themselves for significantly higher mortgage rates compared to just a few months ago. This hike threatens to make homeownership a distant dream for many. - Refinance Borrowers

Borrowers contemplating refinancing their existing mortgages are at a crossroads. With mortgage rates on the rise, the prospect of refinancing becomes less appealing and potentially more costly in the long run. - Homeowners

Existing homeowners with adjustable rate mortgages (ARMs) may soon feel the pinch as their monthly payments rise in response to the soaring rates.

Housing Market Resilience

Despite the adversity posed by rising mortgage rates, the housing market is demonstrating remarkable resilience. Demand for housing remains robust, while the available supply of homes for sale remains limited. This imbalance in supply and demand continues to exert upward pressure on home prices, making it an attractive market for sellers. Massive Boost Coming to Your Wallet! Social Security Payments Skyrocketing by 3.2% in 2024

Expert Recommendations

Navigating these turbulent waters of the real estate market can be challenging, but there are some key considerations for both prospective buyers and current homeowners:

For Prospective Buyers

In this competitive market, it’s essential to shop around for the best mortgage rates. Getting pre-approved for a mortgage before house hunting can provide valuable insights into your borrowing capacity, streamlining the buying process.

For Current Homeowners

If you are an existing homeowner with a high-interest-rate mortgage, now is a crucial time to evaluate the feasibility of refinancing. However, exercise caution and consult with financial advisors to ensure it aligns with your financial situation.

Seek Professional Guidance

For those grappling with questions about mortgage rates and the unpredictable housing market, seeking advice from qualified financial advisors is strongly recommended. Their expertise can help you make informed decisions in these uncertain times.

In conclusion, the housing market’s struggle with surging mortgage rates is reshaping the landscape for prospective buyers and current homeowners alike. While the road ahead appears rocky, informed decision-making and expert guidance can help individuals navigate this challenging terrain.